About

Essar Global Fund invests, builds and nurtures a portfolio of world-class companies through Essar Capital, its investment manager.

Investment Themes

Investment Objectives

Focus on Future

ENERGY

Delivering cleaner/greener energy solutions

- Provide new environmentally beneficial source of energy in India

- Transform Essar Oil UK to become a global benchmark for green refineries

- Build a hub for the UK’s upcoming hydrogen transformation

METALS & MINING

Localise the supply chains for the industry

- Build an energy compliant state-of-the-art steel plant

- Provide the lowest cost high grade green iron ore pellet in the United States and India

INFRASTRUCTURE & LOGISTICS

Create logistics network, storage solutions and platforms by leveraging technology

- Enable trade and transport services across the industrial hubs in the west and east coasts of India

- Create the largest independent hydrocarbon terminals business in North-West Europe

TECHNOLOGY & RETAIL

To be the trusted go to technology solution integrator

- To architect, deploy, manage and secure the customer’s IT environment through customised solutions

- To integrate intelligent digital networks and platforms

Our DNA is to invest with spirit of an entrepreneur, build assets with the passion of an owner and manage businesses with the discipline of a professional.

Expertise : Creating Value

Essar has invested in a portfolio of world-class companies across sectors and geographies

- Annual revenues of $15 bn

- Established track record of high growth

- Core sector asset creation

Entrepreneurship : Building Assets

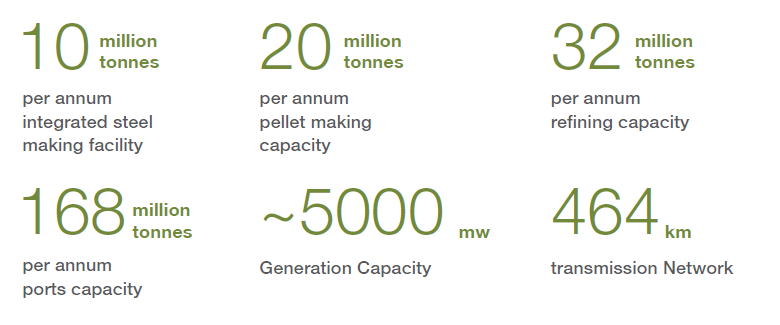

Strategic investments in setting up world-class facilities in Steel, Power, Ports, Oil and Gas.

Experience : Realising Value

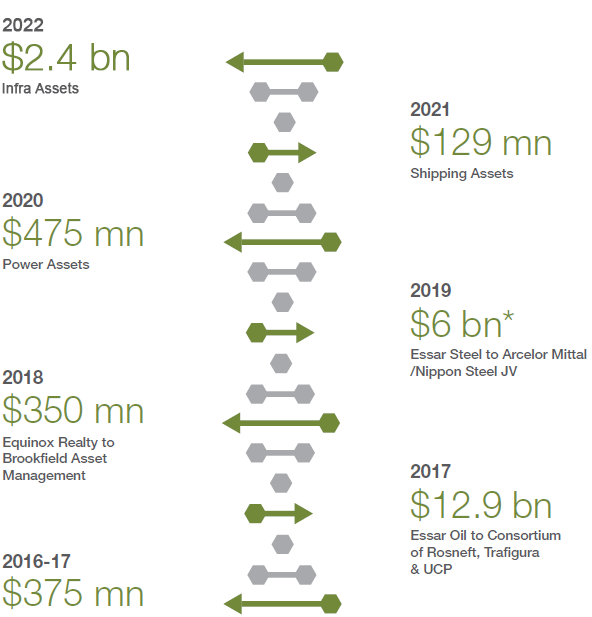

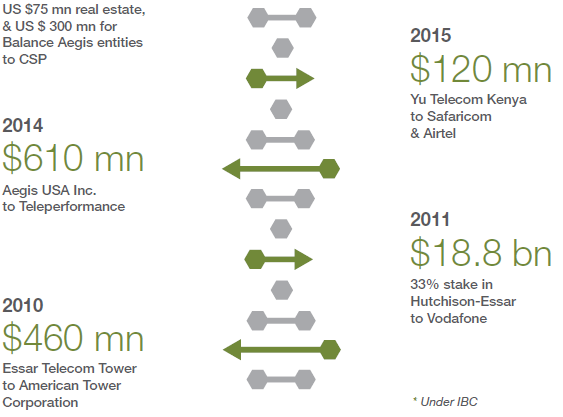

Since 2010, some of the pioneering investments were proactively monetised for an enterprise value of US$ 40 bn through large transactions with foreign and Indian entities.

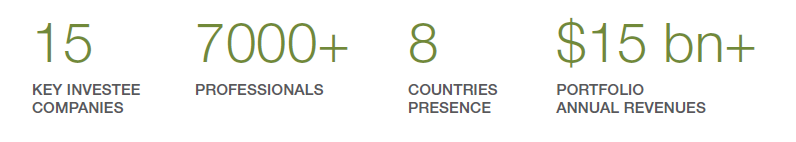

7000+

7000+

PROFESSIONALS

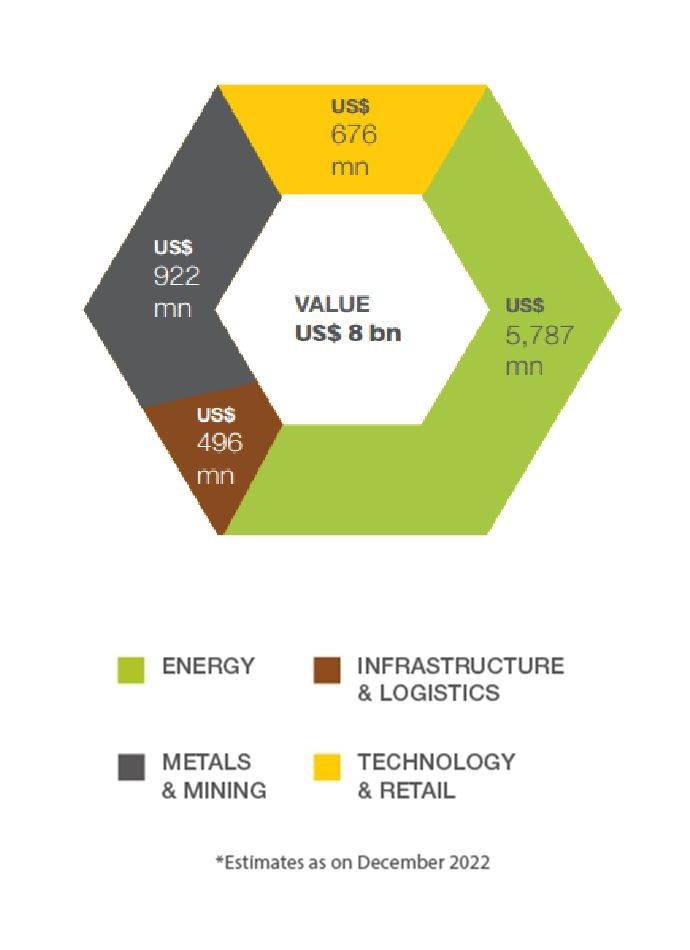

$8 bn

$8 bn

ASSETS UNDER MANAGEMENT

15

15

KEY INVESTEE COMPANIES

50+

50+

YEARS OF ENTREPRENUERSHIP

8

8

COUNTRIES PRESENCE

$15 bn+

$15 bn+

PORTFOLIO ANNUAL REVENUES

Essar Global Fund Limited (EGFL), set up in 2005, invests in building and nurturing assets, and creating value in the core sectors of Energy, Infrastructure & Logistics, Metals & Mining and Technology & Retail.

With Assets Under Management (AUM) of USD 8 billion, as on December 2022, and a net asset value of USD 6 billion, the current investment portfolio of EGFL is future centric and value accretive. Over the last five years, EGFL has rebalanced its portfolio by strategically monetising some of the world class assets and businesses built by Essar, which has an entrepreneurial track record of 50 years. EGFL is now poised to transition its existing assets towards a greener economy and invest in businesses which will transform sector landscapes from carbon to a clean energy ecosystem. The returns from the transition will not only outperform benchmark returns but also contribute to a sustainable society within the framework of Environmental, Social and Governance (ESG) and transform sectors for a post carbon economy.

A new value-centric growth strategy based on Entrepreneurship, Expertise and Experience along with a robust governance system and structure will deliver superior returns, sustainably. EGFL has a globally benchmarked robust risk and regulatory framework. All of its portfolio companies share the Fund’s ESG centric value system, reflecting the philosophy of placing people before profit.

Essar Capital

Essar Capital Limited (“Essar Capital”) is the investment manager of Essar Global Fund Limited (“EGFL”). It monitors and manages the entire portfolio of investments owned by EGFL. Essar Capital is governed by its board of directors and its responsibilities as investment manager of EGFL include:

- Implementing and managing investments and divestments

- Monitoring performance of the portfolio

- Preparing and delivering financial reports of EGFL

- Implementing and overseeing appropriate policies and procedures

Exponentia Ventures

Exponentia Ventures is the venture capital arm of Essar, managing its investments in new economy opportunities, in both B2B and B2C sectors. It invests in disruptive new economy ideas that have digital agility, high-headroom, superior unit economics & the potential of global scale. Exponentia Ventures helps accelerate the growth by leveraging its deep cross-sector experience and global network to create exponential value. It collaborates with management teams to stays focused on building the growth strategy and driving its execution to ensure scale & profitability. Exponentia Venture’s current portfolio spans Green-Tech and B2C-Tech businesses.

Profitable Monetising

- 1995 – First Mover partnership with Hutchison Whampoa and then with Vodafone

- Investment sold to Vodafone in 2011

Value Created

US$18.8 bn*

(86,480 cr)

- Part Sale of Aegis USA Inc. to Teleperformance at $610 million

- Balance to CSP at $300 million

Value Created

US$910 mn

(5,660 cr)

- Sale of 98% stake in Essar Oil to Roseneft, and Trafigura-led consortium

- Sale included 20 MTPA refinery, retail, port and related infrastructure.

Value Created

US$12.9 bn

(86,000 cr)

Portfolio

Essar Global Fund

Infrastructure & Logistics

Metals & Mining

Technology & Retail

50 years’ MILESTONES

1969-1990

1969-90

Shashi Ruia wins major contract worth Rs 2.3 crore for construction of outer breakwater for Madras Port, thus laying the foundation of Essar

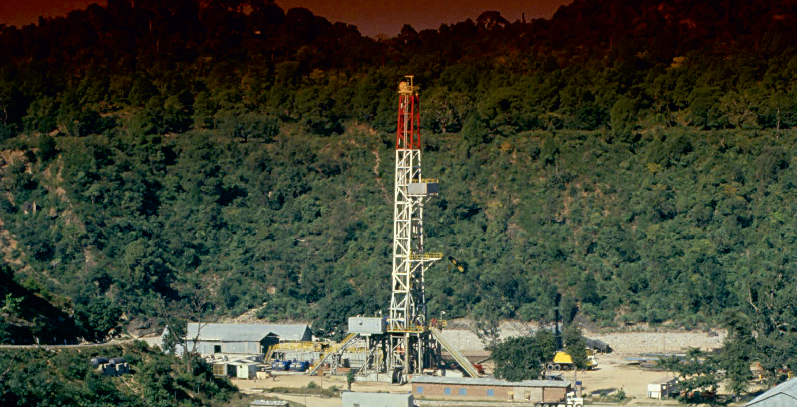

Offshore and Energy Divisions setup to undertake specialized offshore and drilling activities under the Essar Constructions umbrella

1991-2000

1991-2000

Essar conceptualises 515 MW combined cycle power plant at Hazira as India’s first independent power producer

Essar Oil awarded several exploration and development blocks, including the Ratna and R series blocks with proven reserves of 87 million barrels of oil and 1.2 billion cubic metres of gas

Essar Telecom obtains licenses to operate cellular phone services in Delhi, UP (east), Haryana, Rajasthan and Punjab; holds license for basic services in Punjab. Essar Telecom crosses 1 lakh subscribers in Delhi and is poised to become one of India’s

2001-2010

2001-2010

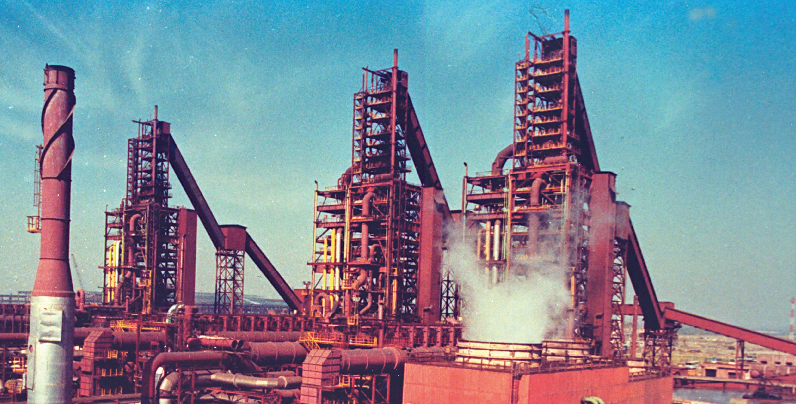

Essar Steel becomes integrated steel player by completing acquisition of Hy-Grade Pellets Limited (HGPL) and Steel Corporation of Gujarat Limited (SCGL) from Stemcor, UK

Essar Global acquires Minnesota Steel LLC, a US-based steel company with estimated iron ore reserves of over 1.4 billion tonnes in the Mesabi Iron Range, northeast Minnesota

Essar sets up The MobileStore, India’s first countrywide chain of multi-brand and multiservice retail outlets dealing in mobile telephony

Commercial production starts at Vadinar Refinery with initial capacity of 10.5 million tonnes

2011-2020

2011-20

Essar Energy enters into agreement to buy Royal Dutch Shell’s Stanlow refinery for US$350 million

Vadinar refinery capacity expanded to 18 million tonnes; an optimisation project adds another 2 million tonnes, with overall capacity going up to 20 million tonnes. Refinery complexity enhanced from 6.1 during inception to 11.8.

Essar concludes sale of Aegis to Capital Square Partners for US$300 million (Approximately Rs 2,000 crore)

Essar Energy and Oil Bidco successfully conclude sale of Essar Oil Limited to Rosneft and TrafiguraUCP consortium for US$12.9 billion

Essar signs GSPA with GAIL for offtake of entire production from Raniganj East CBM block

Essar Power adds to capacity of National Grid, commissions 337-km, 400 kV Mahan-Sipat transmission line

Essar completes Rs 8,000-crore capex cycle for 2×600 MW Mahan power project; commissions second unit

Essar builds India’s largest iron ore handling complex of 24 MTPA at Vizag Port with Rs 830 crore investment; dedicates it to the nation

AGC Networks acquires Black Box, creating a significant global technology solutions provider

Essar Global repays all debt to Indian and foreign lenders. Reduces groupwide debt by over Rs 130,000 crore

Contact Us

Essar House, 11 KK Marg, Mahalaxmi, Mumbai 400 034, India.

Tel: +91 22 6660 1100

Email: contactus@essar.com

The Evolution of Essar

The Essar Group was established by Mr. Shashi Ruia and Mr. Ravi Ruia in 1969, in South India. The company began its operations with the construction of an outer breakwater in Chennai port, an order worth Rs 2.5 crore. Until then, only foreign construction companies would undertake a project of this magnitude and complexity. However, Essar’s chosen policy was to get into areas of import substitution, high technology and national importance.

The 1970s: From construction to shipping

Following this maiden contract, Essar bagged projects at every major port in the country, including Tuticorin, Mangalore, Goa, Kakinada and Nhava-Sheva in Mumbai. Because of Essar’s experience in marine construction projects, the shipping business was a natural extension. This was a time when the movement of petroleum products along the Indian coast was the monopoly of foreign-flag vessels, and no shipping companies in India would venture into this business as it was considered risky and involved the management of advanced technology. Essar saw a great opportunity and bought India’s first private tanker in 1976 for around USD 2 million. The company approached State Bank of India (SBI), a leading public sector bank in India, for a loan. For SBI, the proposal posed a real challenge since it involved a first-of-its-kind transaction for the bank as well! Eventually, the loan was sanctioned, with a repayment structure that was unique for its time. It involved buying an asset against the securitisation of receivables.

The 1980s: Supporting India’s nascent exploration sector

Around this time, Bombay High had just started producing oil, which needed to be transported onshore. Essar teamed up with Brown & Root of USA in laying an under-sea pipeline from the offshore Bassein gas field to Hazira. Later, it went on to buy a specialized pipe-laying barge to undertake this kind of activity.

The construction and shipping businesses grew rapidly and Essar gradually established itself as a leading marine and industrial construction company. In the early 1980s, when the government opened up the ownership and operation of Offshore Supply Vessels (OSV) to private Indian companies, Essar was one of the first to enter the fray. In addition to OSVs, it bought Diving Support Vessels and Multi Support Vessels. The aim was to build a diverse fleet that could help hedge any downturns in the business. As a result, while most shipping companies in India were making losses in the 80s, Essar was reaping profits.

Entering contract drilling

Around the mid-1980s, the Government also opened up the contract drilling business to Indian private companies. Essar again grabbed the opportunity and went on to become India’s largest rig operator in the private sector. It owned 11 land rigs, one offshore rig and a drill ship.

The Late 1980s: Foray into core sector manufacturing

Until the mid-1980s, Essar was focused on the service sectors of construction and shipping, which were prone to cyclical volatility. In order to lend stability to the Group, Essar planned to enter manufacturing. The challenge was to select a sector that was an import substitute, with a product that had long-term demand and served a national purpose.

Stability from steel

India in those days had secondary steel makers who used imported scrap to produce steel. Scrap prices were volatile and had to be purchased with precious foreign exchange. Moreover, the quality of scrap was also not always up to the mark. The only alternative to scrap was sponge iron, but there were no sponge iron manufacturers on the west coast of India despite a large number of users. This prompted Essar to start manufacturing sponge iron. Again, breaking the tradition of locating manufacturing facilities close to the mines, the Company chose to build the plant at Hazira, a port on the west coast of India. Hazira was also the land fall point for gas from the Bassein gas field in Bombay High.

The sponge iron plant became a hugely successful venture. Essar followed up this success, by setting up a pellet plant in Visakhapatnam as part of its backward integration strategy. This was not sufficient for the business to achieve and sustain long-term growth. So Essar set up steel manufacturing facilities at Hazira with the objective of gaining value addition.

The Early 1990s: Making inroads

In the early 1990s, the Indian economy was liberalised and many industries that were hitherto monopolised by public sector companies were opened up to the private sector. Not one to lag behind, Essar seized every opportunity that came its way. The experience in contract drilling prompted the Group to venture into the upstream in the Oil sector—i.e. exploration & production—and downstream, into refining. Essar also entered the power and telecom sectors as and when they were opened up to private participation.

By this time, all of Essar’s businesses had grown significantly and the time had come for managing each business as an independent company. Six business areas in the core sector—Construction, Shipping, Steel, Power, Oil & Gas, and Telecommunications—were identified as growth drivers for the Group.

A slew of projects in each of these businesses were initiated in the 1990s when the Indian economy was booming.

Steel: The uncertainties of a cyclical business

The sponge iron plant, initially set up with a capacity of 0.88 million tonne per annum (MTPA), was expanded to produce 1.32 MTPA. As part of the backward integration, a 4 MTPA pellet plant was set up in Visakhapatnam; forward integration was achieved with a 2 MTPA steel plant. Essar Steel was now a producer of flat steel and joined the select group of Indian companies that produced this commodity.

When Essar conceived the project, international steel prices were in the region of USD 450 per tonne. When commercial production began in 1996, this had fallen to USD 380 per tonne. Worse was to follow.

Essar had financed the project through a combination of rupee debt and Floating Rate Notes (FRN)—both on a five-year tenure. This arrangement was made for two principal reasons: One, Indian financial institutions were not in a position to lend for a longer term; two, raising foreign currency debt beyond five years was not permitted at that time.

The Late 1990s: Financial crisis

The FRNs were due for refinancing in 1999, the year that marked the end of the five-year term. Essar began the process of refinancing one year in advance, in May 1998. The company received underwriting commitments from Chase and Lehman Brothers. Just before the issue was launched, India tested the nuclear bomb at Pokhran. This led to financial sanctions being imposed on India and Indian companies no longer had access to foreign funds. Essar’s Indian lenders refused to bail the company out. Left with no option, Essar was forced to default on the FRN loan, despite having made concrete plans for refinancing.

Simultaneously, global steel prices started tumbling and reached a historic low of USD 180 per tonne. At that price, steel plant operations were simply unsustainable. Many steel companies at that time went down under. Top-lines crashed, while interest rates were at their highest ever (Prime Lending Rates had touched 17 percent). Being one of the low-cost steel producers, Essar managed to make operating profits. But this was not sufficient to meet its debt obligations.

Early 2000s: Rebuilding

Essar did not succumb to the pressure. It vigorously worked towards restructuring its balance sheet, drawing up a three-pronged strategy to address the issue: Increase capacity, move to value-added segments and bring down finance costs.

The steel generation capacity at the Hazira plant was raised from 2 MTPA to 2.4 MTPA through de-bottlenecking. Work also started on expanding capacity from 2.4 MTPA to 4.6 MTPA through brownfield expansion, which requires far less capital than similar greenfield projects The cost of this project was USD 2.64 billion. This brought down the capital cost per tonne of steel, which helped reduce overall cost of production. Sponge iron generation capacity was also increased to 5.5 MTPA. The Research & Development team developed high-end products for specialized applications, like interstitial free steel for auto and auto components, high-end API grade steel for the petroleum industry, steel conforming to the ABS standard for ship building industry and so on. In this way, the share of value-added products increased from 35 percent to 70 percent of total production.

Financial restructuring

Essar negotiated with the FRN holders for a one-time settlement and refinanced its entire rupee debt at a lower cost. In order to improve the efficiency, Essar Steel bought Stemcor’s 51 percent stake in HyGrade Pellets Limited, the pellet making venture of Essar. It also bought Stemcor’s 100 percent stake in Steel Corporation of Gujarat (SCGL) which had set up a 1.2 MTPA cold-rolling complex at Hazira. Subsequent to the HyGrade takeover, the pellet making capacity was enhanced to 8 MTPA. At the same time, the 8 MTPA iron ore beneficiation plant at Bailadila and the 267-km slurry pipeline were completed. This has improved the quality of the ore and reduced the transportation cost. The takeover of SCGL has enabled Essar to widen its product base and cater to a larger segment of industries.

All these measures have made Essar Steel, the largest integrated steel producer on India’s west coast and one of the largest producers of flat steel in the country. Essar continues to be the largest Indian exporter of flat steel.

The Power Business

When the power sector was opened up for private participation, Essar was one of the first companies to enter the fray. The power plant was originally conceived to cater to Essar Steel’s requirements, but was later converted to an independent producer with a capacity of 515 MW. The combined cycle power plant was state-of-the-art and was capable of using multi fuel with technology from General Electric, Hanjung and Siemens. The commissioning was completed in October 1997. Today, the Hazira power plant has two power purchase agreements—one with the Gujarat State Electricity Board and the second with Essar Steel. The plant has a high availability factor of 99 percent. The project was funded by Indian financial institutions and the ECB. This debt was refinanced later when the government set up the Power Finance Corporation. This plant helped Essar Constructions garner expertise in building power plants in addition to its valuable experience in other sectors, including the steel plant for Essar Steel.

Essar’s entry into oil & gas refining

The experience of contract drilling gave Essar an opportunity to understand the oil business better, and setting up the refinery was the logical thing to do. Work on the refinery began in 1994, and by 1995, the necessary funding was in place. There was an FCCB (Foreign Currency Convertible Bonds) component that needed to be raised abroad in the latter half of 1998. Work on the refinery was progressing as per schedule till the first quarter of 1998.

In the second quarter, a devastating cyclone hit the western coast of India damaging several structures in the refinery site. Also, the financial sanctions imposed on India subsequent to the Pokhran nuclear test in May 1998 ensured that Essar was banned from raising FCCBs. Both these factors led to a stoppage of work at the refinery

The Mid-2000s: Resurrecting the Essar Oil Refinery

In early 2005, Essar restructured the balance sheet and work resumed with renewed vigor on completing the refinery project. During the period of stoppage, Essar had wisely planned for technology upgrades. Within 18 months after work resumed, Essar began commissioning the refinery in phases. Production started in November 2006 with a capacity of 7.5 MTPA.

The Telecom Business

One of Essar’s strengths has been its ability to invest in businesses that have the potential for growth and its strategy to diversify as a hedge against cyclicality. In 1995, a few months after mobile telephony was opened up to private participation, Essar became the first company to start GSM operations in Delhi under the brand name, Essar Cellphones. Since Essar did not have prior experience in this industry, it roped in Swiss PTT as a joint venture partner. Essar then acquired licenses for Eastern UP, Rajasthan, Haryana and Punjab.

In those early days of the telecom boom in India, effective policies were lacking and private telecom businesses were faced with several problems. In 1999, the government announced a new telecom policy that was more conducive to growth. Essar braced itself for the oncoming challenge. However, Swiss PTT wanted to shut shop as part of its strategy to exit all Asian operations.

Essar replaced Swiss PTT with Hutchison as partner. The joint venture company then went about consolidating operations and acquiring various telecom circles. In 2005, when the government came out with the unified licensing scheme, the JV started merging all the telecom circles. By 2006, all the circles were under one umbrella—Hutchison Essar Limited. Essar owned 33% stake in the consolidated entity. Independently, Essar had acquired licenses in seven circles where Hutchison Essar did not have operations, and in four circles of BPL. Essar merged these circles into Hutchison Essar to create a telecom major.

In 2006, Hutchison, too, decided to exit India. Essar wanted to buy out Hutchison’s stake and tied up a line of credit of over USD 11 billion. After a fierce round of bidding that involved several corporations, Vodafone bought the Hutchison stake valued at USD 11.5 billion.

What started out with an initial investment of USD 800 million had reached a valuation of USD18.8 billion in just six years. Hutchison Essar’s subscriber base, too, has risen from 1,50,000 to 28 million. Thus Essar was able to build one of the most valuable telecom companies in the world. Now, Essar is all set to team up with the new JV partner Vodafone to take growth to the next level.

Shipping & Logistics

Essar Shipping diversified and modernised its fleet in the early 1990s. It bought six new double-hull double-bottom Suezmax tankers between 1991 and 1994, a time when no shipping companies were investing in such vessels. The promoters could foresee the demand, a vision that paid rich dividends. Essar became the first Indian company to operate in the waters of the Atlantic. All its Suezmax tankers were approved by oil majors, an endorsement that fetches a premium in freight. Essar had contracts with Chevron, Exxon-Mobil, Stat Oil, Shell, etc. and more than 70 percent of its shipping revenues came from international operations.

Even during the downturn in the shipping industry, Essar Shipping registered profits. In this business, too, Essar kept refinancing the debt to reduce finance costs. In 2005, when the vessel rates peaked, Essar sold its five Suezmax tankers at the price at which they were bought in 1994. The funds from the sale of the tankers were used to buy two very large crude carriers (VLCC) of modern vintage and three Cape-size vessels.

Investing in an end-to-end logistics infrastructure

Realising the need to be a niche player in the global transportation industry, Essar drew up a plan to be a complete logistics solution provider. All these activities were consolidated under Essar Shipping and Logistics Limited.

It invested in relevant logistics assets. This included an oil terminal at Vadinar with a capacity to receive 32 MTPA of crude, 14 MTPA product dispatch facilities through sea, crude storage facilities, and product dispatch facilities by road and rail. Similarly, Essar Bulk Terminal was set up to create bulk terminal facilities at Hazira and other ports. At Hazira, a deep draft berth and shipping channel was constructed to enhance the cargo handling capacity by bringing larger vessels alongside the berth.

Essar Logistics took care of the movement of cargo, generated by Essar Steel and Essar Oil, by road. It had a fleet of over 100 vehicles of varying capacities.

Essar also reentered the contract drilling services business after a hiatus of three years. A fleet of 13 onshore rigs and a semi-submersible rig were deployed with clients in India and abroad.

Construction

Essar Constructions grew its activities considerably over the years. In addition to outside contracts, it executed all of Essar’s internal projects. All these projects helped transform Essar Constructions into a leading EPC contractor. Essar Constructions executed pipe laying contracts for all the major oil companies in India, and drinking water pipelines in Gujarat, Tamilnadu and Rajasthan. The pipe laying division of the company was certified at ISO 9002. After achieving success and recognition in India, the Company was now poised to venture overseas.

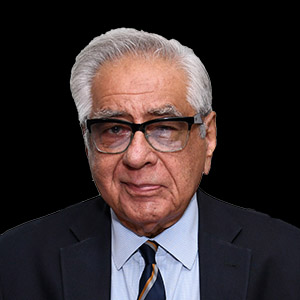

Shashi Ruia

Founder

Shashi Ruia began his career in the family business in 1965 under the guidance of his father, the late Nand Kishore Ruia. Along with brother Ravi, Shashi Ruia laid the foundation of Essar and spearheaded its business strategy, diversification and growth.

Ravi Ruia

Founder

Ravi Ruia belongs to the generation of industrialists who have played a significant role in leading India’s industrial renaissance. His entrepreneurial abilities have enabled the Essar Global portfolio of companies to become one of the leading names in global industry.

Prashant Ruia

Prashant is part of the second generation of the Ruia family that founded Essar. Essar was founded in 1969 by his father, Shashi Ruia and uncle Ravi Ruia.

Anshuman Ruia

Anshuman Ruia is known for his financial expertise and project execution skills. He has overseen Essar’s BPO and Power businesses,

Smiti Kanodia

Smiti is a self-driven business leader and a true entrepreneur at heart. With over 15 years of experience in diverse fields including media & publishing, corporate communications

Rewant Ruia

Rewant’s global exposure, fresh perspectives and arc of activities has contributed to Essar’s strategy and operations in the mining, steel and retail sectors both in India and abroad.

Dhanpat Nahata

General Partner, Strategy and Risk

Vikas Saraf

Non-Executive Director

Haseeb Drabu

Advisor

Vinod Krishnan

Chief Digital and Information Officer

Kailash Daultani

Managing Director, Finance & Tresaury

Nikhilesh Nagar

Managing Director, Accounts & Compliance

Pushkar Popat

Managing Director, M&A Structuring

Uday Gajudhar

Director

Manish Kedia

Senior VP, Corporate Affairs

Priya Chakravarty

Senior Director, HR

Nilesh Bhagat

Senior Director, Taxation

Jatinder Mehra

Vice Chairman & Operating Partner, Metals & Mining

B. C. Tripathi

Vice Chairman, Exploration & Production

Rajiv Agarwal

MD & CEO, Essar Ports

Madhu Vuppuluri

Operating Partner, Metals & Mining

Srinivasan Vaidyanathan

Operating Partner, Technology & Retail

Viral Gathani

Managing Director, Finance, Energy

Sanjay Palve

Sr. Managing Director, Finance, Infrastructure, Technology & Retail

Rakesh Kankanala

Managing Director, M&A, Infrastructure

Andrew Wright

Managing Director, Legal, Energy

Rahul Taneja

Managing Director, Human Capital

Naushad Ansari

Managing Director, Business Development, Metals & Mining

RK Sukhdevsinghji

Advisor

Satish Mathur

Advisor, CEO, Essar Foundation

Deepak Maheshwari

CEO, Essar Oil UK

Kush Singh

CEO, Essar Power

Pankaj Kalra

CEO , Essar Exploration & Production Ltd

Shiba Panda

CEO, Essar Projects

Mike Gaynon

CEO, Stanlow Terminals

SS Mohanthy

CEO, Essar Minmet Ltd

Pravin Bajpai

CEO, PT MBL, Indonesia

Sanjeev Verma

CEO, Black Box

Pratik Gupta

CEO, Pluckk

50

50 $15

$15